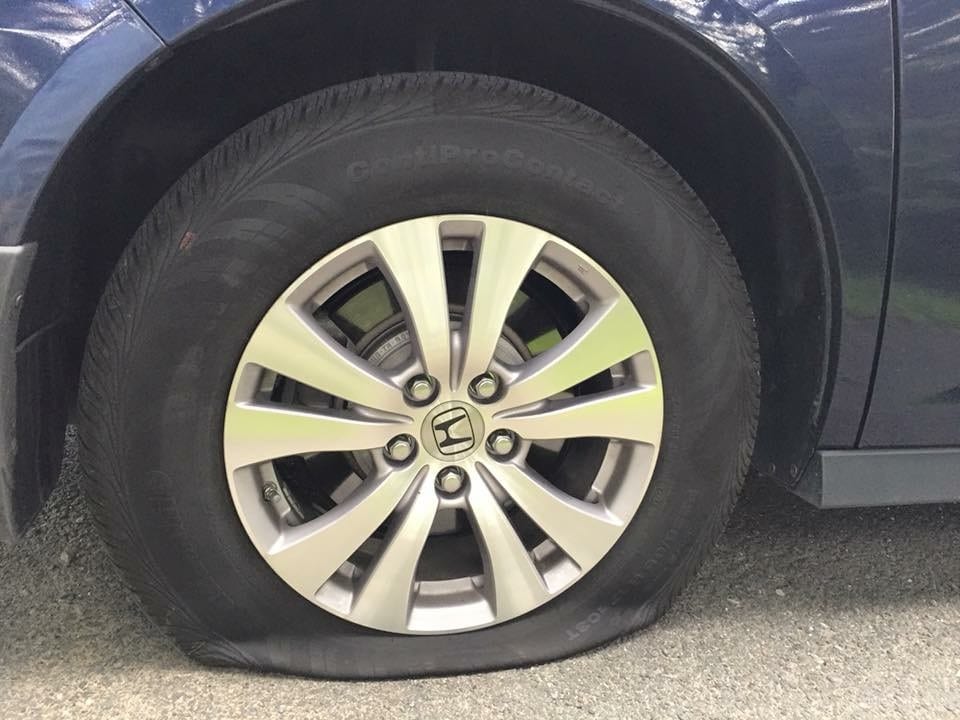

You’re driving up Route 9 in Clifton Park and you see something in the road. There’s a car in the lane next to you and you’re unable to swerve. You drive over what appears to be a piece of metal lying in the road and everything seems fine. Five minutes later, as you’re approaching the roundabouts in Malta, a message on your dashboard tells you to check your tire pressure. Sure enough, you have a flat tire. What do you do? Do you have Roadside Assistance coverage?

Roadside Assistance

There are a variety of options to choose from when considering Roadside protection. Before we dig into those options, we need to discuss what types of events are covered. The following list encompasses the most common needs that would be covered:

- Towing

- Tire change

- Jumpstart

- Lockout

- Running out of gas

- Most other services that can be provided at the side of the road by a towing provider

Roadside Membership

Most new cars come with complimentary Roadside Assistance from the vehicle manufacturer for a period of time, usually while the car us under warranty. If so, you can call their number and they’ll dispatch a local provider to change your tire or tow you to a service station.

Also, many people pay for a Roadside Membership such as AAA or Allstate Motor Club. These Roadside Memberships typically cover a person (or a family) while in any car, whether they’re driving their car, or they’re a passenger in someone else’s. In addition to Roadside Assistance, they may include other benefits such as trip interruption benefits, travel discounts and more. Memberships typically start around $100/year and could be more depending on the level of benefits you choose.

Roadside Assistance Coverage on your Auto Insurance

Many auto insurance policies allow you to add an optional coverage for Roadside Assistance for a nominal charge. This coverage would apply for the car which has the coverage no matter who is driving it. This is a distinct difference from the Roadside Membership, where the person is the basis of coverage. Also, coverage amounts for Roadside Assistance on a car insurance policy are typically between $75 and $125, which is usually less than the coverage amounts provided by a Roadside Membership. Since the coverage amounts are lower, the cost of the coverage is usually much lower and are less than $15/year per car in many cases.

Which one is best for me?

You really have three options.

- Roadside Membership

- Roadside Coverage on your Auto Insurance

- Pay out of pocket or change the tire yourself

Working through this list backwards, if you’re the type of person who rarely needs Roadside Assistance, is comfortable with changing a tire or diagnosing minor mechanical problems yourself and would never think to call for Roadside Assistance, you might not need the coverage at all. If you’re someone who doesn’t travel far from the local area but wants some level of coverage, adding Roadside Assistance coverage on your auto insurance policy is probably a good fit for you. Lastly, if you take a lot of road trips or feel more comfortable with a high level of coverage, a Roadside Assistance membership makes a lot of sense for you.

For more information on Roadside Assistance protection options, please Contact Us, visit our office in Clifton Park, NY, or call 518-877-7447.

John Lofrumento, CFP®, FSCP®, RICP®

John Lofrumento, CFP®, FSCP®, RICP®

President, The Lofrumento Agency

Clifton Park, NY / Ballston Lake, NY