There are a lot of types of life insurance available. Some policies are designed to last as long as you’re alive, whether you die tomorrow, or you live to age 100. These are typically called Permanent Life Insurance policies. Other policies are designed to last for a specified period of time and these are called Term Life Insurance policies. In this post, we’ll be looking at Term Life Insurance.

Length of Term

The term is the length of time the policy is intended for. Common term lengths are 10, 15, 20, 25, or 30 years. If you die before the end of the term, the policy pays the death benefit to your beneficiary.

End of Term

At the end of the term period, you’ll most likely have the option to keep the policy, but the premium will significantly increase to the point where it is likely unaffordable. Most people cancel their policy at the end of the term or they convert their coverage to Permanent Life Insurance.

Converting your Term Life Insurance

If your Term Life Insurance Policy includes a conversion privilege, you’ll have the option to covert part or all your coverage to a permanent policy without the need for underwriting. This means that if you have a $500,000 term policy with a conversion privilege, you’ll have the ability to convert up to $500,000 of coverage to a permanent policy, designed to last until you die, and there are no medical questions. Whatever health rating you had when you purchased the term policy will also apply to the permanent policy. The premiums for the permanent policy will be based upon your age at the time of conversion.

Term Life Insurance Premiums

Most Term Life Insurance policies have level premiums for the term period. That means that if you purchase a 20-year term policy, your premium in year 1 will be the same as your premium in year 20. The shorter the length of the term, the smaller the premium will be.

Very frequently, I find that Term Life Insurance is significantly cheaper than people think.

How to Choose the right Length of Term and Coverage Amount

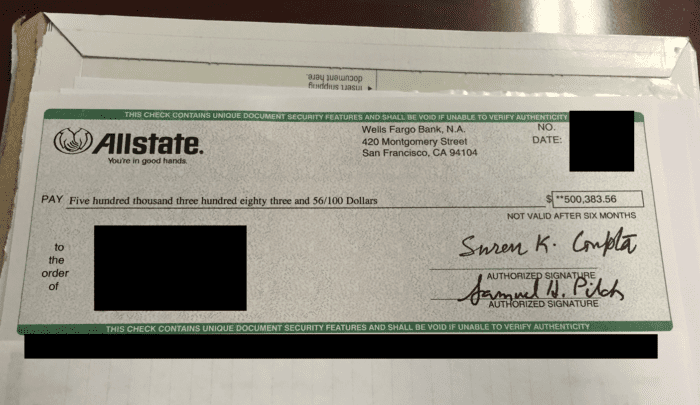

It’s best to work with a licensed agent or broker to help determine the appropriate length and amount of insurance because every situation is different. Typically, people choose the length depending on the reason for the policy. For example, if they’re buying the insurance because of their mortgage, the length of the term will be similar to the length of the mortgage. For the coverage amount, a calculation will need to be made to determine how much is needed to satisfy your beneficiary’s needs. I’ve delivered many death benefit claim checks over the years (including the one pictured above) and not one person has ever told me that the check was for too much money. Unfortunately, some have said that the check was not enough.

Please have a conversation with us to help you determine which policy makes the most sense for your situation when considering your needs and your current budget.

John Lofrumento, CFP®, FSCP®, RICP®

John Lofrumento, CFP®, FSCP®, RICP®

President, The Lofrumento Agency

Clifton Park, NY / Ballston Lake, NY