Life Insurance

If you’re like most people, you know that you need life insurance but you’re not exactly sure what type you need. There are a lot of options and you might not be sure how to decide what’s right for you and your family. Here is a quick overview of the two main types of coverage you can purchase. You may find that you need one or the other or even a combination of both. Every situation is different and I am happy to help you choose the right fit for your situation.

Term Life

If your main objective is to pay off your mortgage or replace income while your children are still financially dependent on you, term life is probably a good value for you. It’s coverage that is good for a set term of years. For example, you could buy a 20-year term life policy. If you die within the 20-year term of years, the policy pays the death benefit to your beneficiary. If you outlive the term and the policy ends, you no longer have life insurance and you don’t get any money back either. Term life insurance is usually inexpensive because the insurance company is betting that you’re going to outlive the policy, and most people do.

Whole Life (Permanent Life)

People often say Whole life when they mean to say Permanent life. Whole life is simply one type of Permanent life insurance. Basically, Permanent life insurance is coverage which, in most cases, is designed to last through your life expectancy. These are useful policies if you would like to have coverage when you’re older (70+) and they typically cover final expenses. They can also be used to pass wealth down to younger generations or to provide coverage for complex estate situations. These policies typically build a cash value within them which is a similar concept to building equity in your home. Later in life, if you decide you no longer want or need your policy, you can likely surrender it and receive the cash value from the insurance company.

Both Term and Permanent life have important uses. As a life insurance broker, I represent 20+ life insurance companies and can help you choose the option that best meets your needs and then find the insurance company that can provide that option at the lowest cost.

If you’d like to have a conversation about your particular situation, please visit our Contact Us page to schedule a conversation with me.

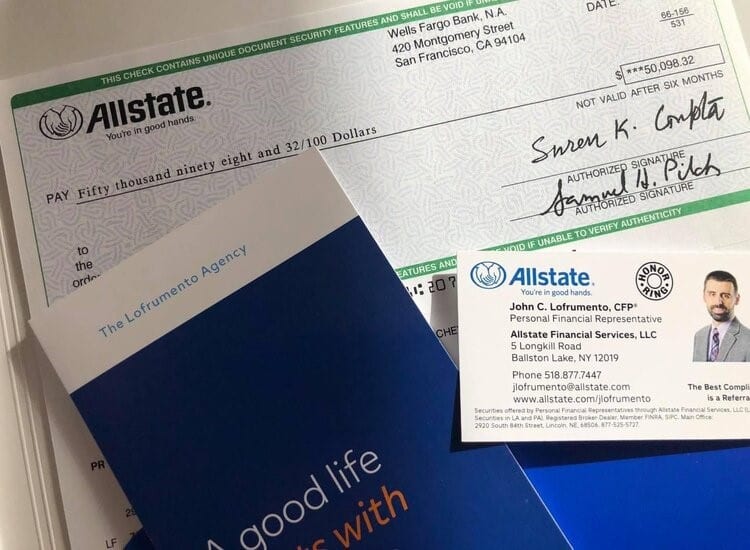

John Lofrumento, CFP®, FSCP®, RICP®

John Lofrumento, CFP®, FSCP®, RICP®

President, The Lofrumento Agency

Clifton Park, NY / Ballston Lake, NY